Marubeni Ventures Announces Investment in Pace, a BNPL Service Provider in Singapore

~Developing An Omni-Channel Payment Platform in Asia~

Marubeni Ventures Limited (“Marubeni Ventures”) announces its investment in Pace (Headquarters: Singapore, Founder & CEO: Turochas ‘T’ Fuad), a “Buy Now Pay Later (BNPL)” service provider in Singapore, in a Series A round along with existing shareholders Vertex Ventures SEA and India of Singapore and Alpha JWC Ventures of Indonesia.

Pace was founded in 2020 by Mr. Fuad, a prominent serial entrepreneur in Southeast Asia, and is rolling out a BNPL mobile payment service for online and offline use in 2021. It has a particular strength in adoption in brick-and-mortar stores that handle branded products and other high value-added products. More than 3,000 stores in Singapore, Malaysia, Hong Kong, and Thailand have already adopted the service, and its use is rapidly expanding, especially among the younger generation.

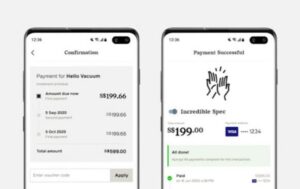

Consumers can purchase products with up to three interest-free payments over 60 days by simply downloading the smartphone app provided by Pace and completing a simple procedure on the spot. With the introduction of Pace, stores can offer consumers more flexible payment methods than ever before, which is expected to increase sales through attracting new customers.

Pace’s mission is to “democratize financial services for all,” and with the funds raised this time, the company will strengthen its technology platform, operations, and business development. Pace plans to expand its business to Japan, Korea and Taiwan. Through this investment, Marubeni Ventures will support Pace’s further expansion and development.

Pace

Headquarter : Singapore

Founder & CEO : Turochas ‘T’ Fuad

Shareholders : Alpha JWC, AppWorks, Atinum Partners, UOB Venture Management, Vertex Ventures Southeast Asia and India, etc.

Pace is a fast-growing fintech solutions company from Singapore with a mission to democratize financial services across Asia. It aims to build a banking engine that can operate across countries easily to help merchants create sales efficiencies and provide consumers with an option to spend sustainably. Its “Buy Now Pay Later’’ (BNPL) solution for offline and online merchants matches customers with appropriate spend limits and allows them to split their purchases over three interest-free payments. Pace currently operates in Singapore, Malaysia, Hong Kong, and Thailand.